The company might decide to pursue this project instead of the new factory project because it is expected to generate more value per unit of investment. The importance of PI in investment decision-making cannot be overstated. It serves as a crucial tool for comparing projects of different scales and helps in identifying investments that yield the most value relative to their cost.

Profitability Index Formula

As the financial world continues to evolve, the PI remains a timeless and essential tool, illuminating the path to prudent and profitable investments. If the IRR is lower than the cost of capital, the project should be killed. Before diving into the calculations, preparing the spreadsheet is crucial to make the process seamless. Under ‘Year,’ list each year of the project duration, beginning with year 0 for the initial investment, which is logged as a negative value. We found out all of the above-discounted cash flows by using the same method. Only the cost of capital changed due to the increase in the number of years.

Effectiveness of PI

This invaluable tool provides users with a numeric value that represents a project’s profitability relative to its initial investment. If a PI is less than 1, it suggests that the project’s present value is less than the initial investment, indicating it’s unprofitable and should typically be rejected. However, as with any analytical tool, the key to harnessing the full potential of the Profitability Index lies in its careful application. Accurate estimation of future cash flows, prudent selection of a discount rate, and thorough consideration of all initial investment costs are critical to deriving a meaningful PI.

Alternative Methods for Measuring PI Calculation

Now that we have obtained the PI value for both the projects, let’s look into its application for appraising projects. We would discuss and exemplify the above three applications of profitability index later in this article, but let’s first look into how it is computed. This initial setup ensures that the data is neatly arranged, making the calculation process that follows more intuitive and less prone to errors.

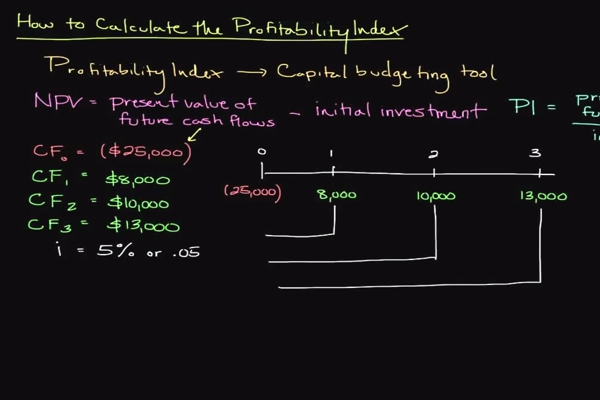

How to Calculate the Profitability Index

We rely on PI to make informed decisions by identifying which projects are likely to contribute more significantly to our overall growth and financial health. All one needs to do is to find out the present value of future cash flows and then divide it by the initial investment of the project. The new factory project is expected to cost $2 million and generate cash flows of $300,000 per year for the next 5 years, also with a discount rate of 10%. The profitability index is the ratio between the present value of future expected cash flows and the initial amount invested in the project. Finally, to compute the PI, we simply divide the present value of future cash flows by the absolute value of the initial investment amount.

- However, even if the PI is widely used for doing cost-benefit analyses, it is not free of demerits.

- The profitability index helps compare and contrast investments and projects a company is considering.

- It is because there are instances where there re larger cash flows, but then the PI is limited due to the restricted profit margins.

- Comparing projects with different lifespans and cash flows can be challenging, but the Profitability Index provides a level playing field for such analyses.

- Are you tired of trying to figure out if your investments are profitable?

The index itself is a calculation of the potential profit of the proposed project. The rule is that a profitability index or ratio greater than 1 indicates that the project should proceed. A profitability index or ratio below 1 indicates that the project should be abandoned. For instance, a PI greater than 1 signals a thumbs-up for profitability—the higher the index, the larger the profit relative to the investment.

It represents the relationship that exists between the costs and the benefits of a potential project. The profitability index is the ratio between the initial amount invested in a project and the present value of future cash flows. The profitability index can help you determine the costs and benefits of a potential project or investment. It’s calculated based on the ratio between the present value of future cash flows and the initial investment. In the realm of financial decision-making, evaluating the potential profitability of an investment project is paramount. Enter the Profitability Index Calculator—a simple yet powerful online tool designed to calculate the profitability index based on the initial investment, interest rate, and a series of yearly cash flows.

The profitability index is calculated by dividing the present value of future cash flows that will be generated by the project by the initial cost of the project. A profitability index of 1 indicates that the project will break even. A pivotal component in calculating PI is the present value of future cash flows.

As per the formula of the profitability index, it can be seen that the project will create an additional value of $1.003 for every $1 invested in the project. Therefore, the project is worth investing since then it is more than 1.00. The cash flow for each year (in the second entry box) should be separated by a comma. Each scenario will demonstrate how PI varies with different investment scales and cash flow patterns. For instance, if the PI ratio of an investment is 2, then it falls under the excellent category, which means that the investment is highly profitable. Although not a perfect approach, profitability index goes a long way toward handling of capital rationing, if used with caution.

In that case, the company should invest in a project that has more PI than this particular project. The best thing about this index is that it allows businesses to compare between different projects whenever they require choosing one out of the other. The projects having more chances of generating profits is the project that the firms are likely to choose. As the value of the profitability index increases, so does the financial attractiveness of the proposed project. Our mission is to provide useful online tools to evaluate investment and compare different saving strategies.

Theoretically, it reveals unprofitability of a proposed investment and suggests rejection of the same. In general terms, the higher the PI metric, the more attractive a proposed investment is. For example, a project that costs $1 million and has a present value of future cash flows of $1.2 million has a PI of 1.2. The Profitability writing off stock Index is highly useful in project evaluation because it not only assesses the relative profitability of projects but also considers the scale of the investment. It allows us to rank competing projects based on the value they add per invested dollar, helping to identify the most efficient use of limited capital.