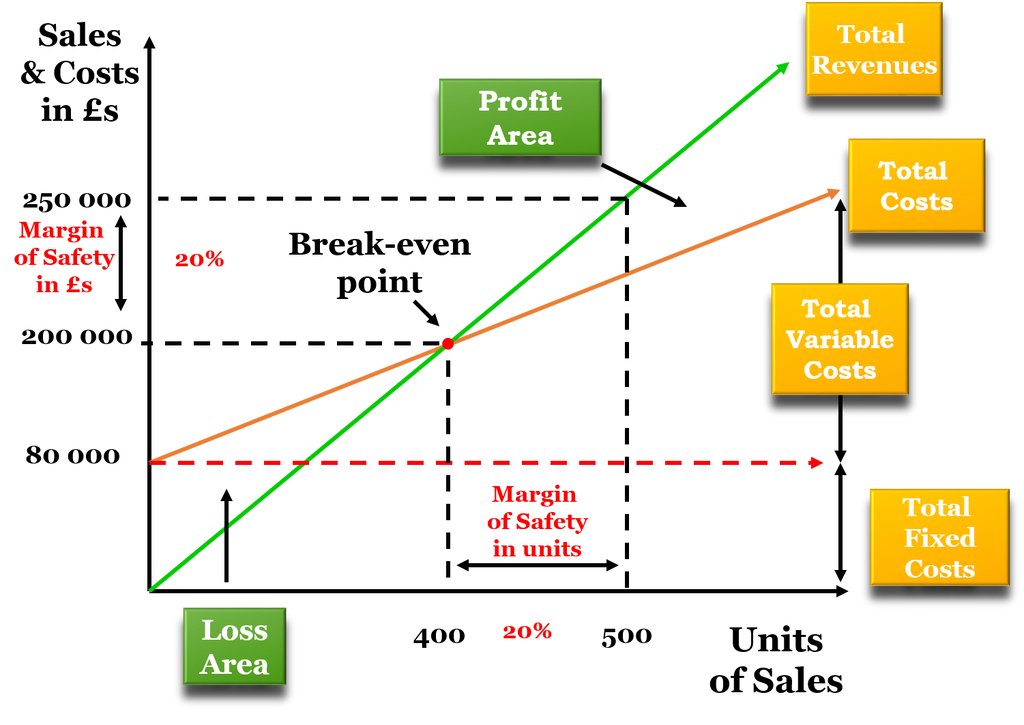

When sales are higher than total costs, it earns a profit but when total costs are higher than total sales, it loses money. A break-even chart visualizes the whole relationship and makes it easier to follow the break-even point. Now that you have break-even, what do you do with this information? You want to find the highest price you can sell the product at and still make a profit.

Calculate Break-Even Point by Sales Dollar – Contribution Margin Method

After entering the end result being solved for (i.e., the net profit of zero), the tool determines the value of the variable (i.e., the number of units that must be sold) that makes the equation true. This is a step further from the base calculations, but having done the math on BEP beforehand, you can easily move on to more complex estimates. We use the formulas for number of units, revenue, margin, and markup in our break-even calculator which conveniently computes them for you. Break-even analysis is a tool that can be used to demonstrate and calculate how much revenue is needed to make a certain amount of profit, assuming expenses remain constant. A simpler version of the break-even chart is known as the profit-volume graph (P/V graph). This graph shows a direct relationship between sales and profits, and it is easy to understand.

Ask a Financial Professional Any Question

The spreadsheet shows you break-even for a range of costs and sales prices. Let’s say that we have a company that sells products priced at $20.00 per unit, so revenue will be equal to the number of units sold multiplied by the $20.00 price tag. Although investors may not be interested in an individual company’s break-even analysis of production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.

Importance of Break-Even Analysis for Your Small Business

The five components of break-even analysis are fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). A breakeven point is used in multiple areas of business and finance. In accounting terms, it refers to the production level at which total production revenue equals total production costs. In investing, the breakeven point is the point at which the original cost equals the market price.

Shape Calculators

We have four types of online calculators with more functionalities for those who are part of the PM Calculators membership. Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales obscure scholarships for college of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers. Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good. In conclusion, just like the output for the goal seek approach in Excel, the implied units needed to be sold for the company to break even come out to 5k.

Can the break-even point be used to predict future profits?

- Note that in the prior example, the fixed costs are “paid for” by the contribution margin.

- If customer demand and sales are higher for the company in a certain period, its variable costs will also move in the same direction and increase (and vice versa).

- Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

- This margin indicates how much of each unit’s sales revenue contributes to covering fixed costs and generating profit once fixed costs are met.

- Our break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan.

The break-even point is the condition of a company or business before it starts to gain profit. This dataset includes the Sales Quantity in units, the Unit Selling Price, the components of Fixed Cost, and the components of Variable Cost. You can use Excel or another spreadsheet to create a break-even analysis chart. SCORE has an Excel template, or you can use this one form Microsoft.

For example, if unit selling prices, unit variable costs, and total fixed costs remain constant, the P/V graph can show how many units must be sold to achieve a target profit. Break-even analysis, or the comparison of sales to fixed costs, is a tool used by businesses and stock and option traders. It is essential in determining the minimum sales volume required to cover total costs and break even. Another limitation is that the breakeven point assumes that sales prices, variable costs per unit, and total fixed costs remain constant, which is often not the case. The price of goods sold at fluctuates, and the cost of raw materials may hardly stay stable. In addition, changes to the relevant range may change, meaning fixed costs can even change.

Everything shown below this point is loss, and everything above it is profit. One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit. Let’s use the following dataset of sales and costs for a product to conduct a break even analysis. A breakeven point tells you what price level, yield, profit, or other metric must be achieved not to lose any money—or to make back an initial investment on a trade or project. Thus, if a project costs $1 million to undertake, it would need to generate $1 million in net profits before it breaks even.

Break-even analysis helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps determine the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions. For options trading, the breakeven point is the market price that an underlying asset must reach for an option buyer to avoid a loss if they exercise the option. The breakeven point doesn’t typically factor in commission costs, although these fees could be included if desired. In corporate accounting, the breakeven point (BEP) is the moment a company’s operations stop being unprofitable and starts to earn a profit.